How to compare different stocks or different funds.

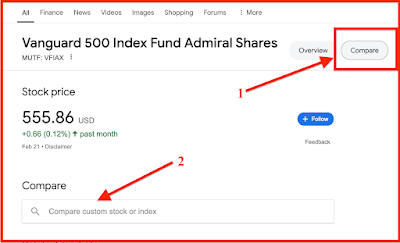

In google (or the URL line): type in ticker vfiax

You will get this:

At the upper right corner of that screen shot above, note the box compare, as below, at the #1 arrow. Click on the compare icon, and then you will get the screenshot below. At the #2 arrow, type in FVIFX.

Type in VFIFX in the box designated with the #2 arrow like this:

And hit return after you type in VFIFX.

You will get this:

Note that it compares VFIAX with VFIFX for the past three months.

You can click on any time period to compare. If you click on max, you will get this:

The difference is not trivial.

With the more conservative VFIFX, you get a 100% return, or you doubled your money over the past sixteen years (2008 to 2024).

On the other hand, with the more aggressive VFIAX (Admiral), you get a return of nearly 400%, which it means it doubled three times (?) in that same time period.

The red and blue lines start to separate as the lines move to the right, because the life cycle funds increase bond holdings as you get older, decreasing the volatility and the risk, but also potentially decreasing return. The theory is that when you are getting ready to retire you want to have a more conservative fund so you don't have wild swings from year-to-year.

We can discuss what this means at later.

One option: diversify. That's what I did.

This year invest in the life cycle fund, VFIFX.

Then next year invest in the more aggressive fund, the VFIAX (Admiral).

Then starting in your third year, fund both IRAs up to the max allowed and change allocations over time as you feel more comfortable with investing.

No comments:

Post a Comment